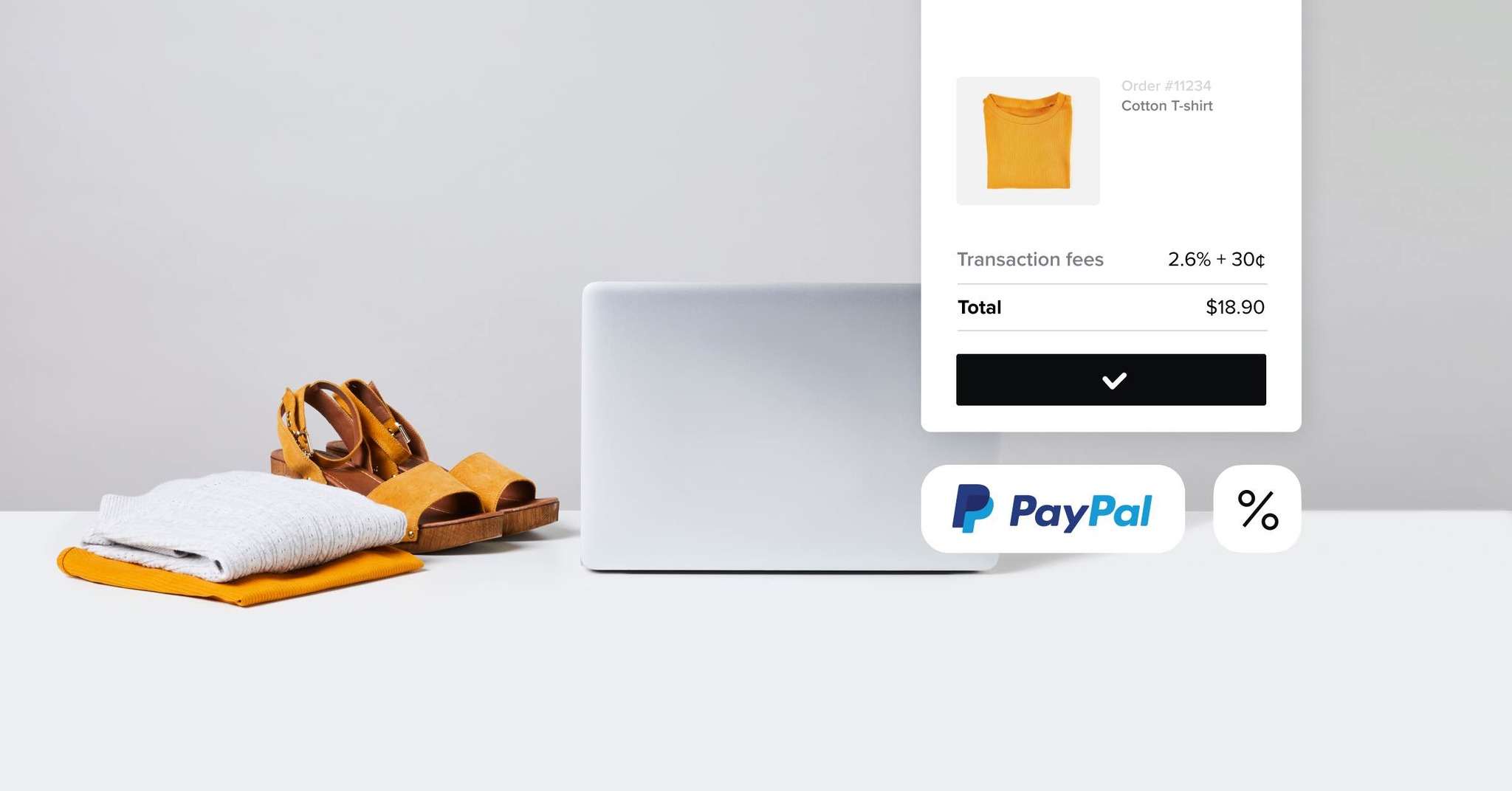

A PayPal Fee Calculator makes it easy to see what charges PayPal costs and how much cash you’ll actually get. The international PayPal fee calculator characteristic helps a number of currencies, making it simpler for users to handle transactions in numerous monetary units. The PayPal Fee Calculator is a versatile instrument designed to help customers quickly and precisely determine the charges associated with their PayPal transactions. There can also be a Help Centre with guides, and a Community Forum on their web site, the place PayPal users can publish questions that other customers can reply. However, it is at all times a good suggestion to double-verify the charges instantly on the PayPal website, especially for giant transactions or worldwide transfers. Standard PayPal Fee Calculator: Used for regular transactions. The PayPal Fee Calculator is designed to be user-pleasant, making it accessible even for individuals who may not be tech-savvy. 3. Select Transaction Type: Choose the type of transaction from options reminiscent of "Goods and Services" or "Friends and Family." Note that charges could fluctuate depending on the transaction kind. After you choose and set up a template, there might be choices that can help you customise your store.

However, keep in mind that it will come with certain pitfalls. It’s a should-have for freelancers, small enterprise house owners, and anyone who desires to maintain their transaction prices in test. Whether you are an individual vendor, a small business owner, or an international trader, this calculator helps you understand the charges charged by PayPal, guaranteeing transparency and accuracy in your monetary dealings. Whether you are a freelancer, online seller, or enterprise proprietor, understanding the charges can considerably impact your monetary planning and pricing technique. As well as, this eBay Fee Calculator is well-known for researching competitor pricing. The PayPal Fee Calculator is a useful instrument for anyone trying to easily calculate transaction fees related to PayPal. 4. Calculate: Click on the calculate paypal button to get the price particulars. Use PayPal’s Customer service Message to inform customers how they can get in contact with you. Accuracy: It ensures you get precise calculations for the charges.

However, keep in mind that it will come with certain pitfalls. It’s a should-have for freelancers, small enterprise house owners, and anyone who desires to maintain their transaction prices in test. Whether you are an individual vendor, a small business owner, or an international trader, this calculator helps you understand the charges charged by PayPal, guaranteeing transparency and accuracy in your monetary dealings. Whether you are a freelancer, online seller, or enterprise proprietor, understanding the charges can considerably impact your monetary planning and pricing technique. As well as, this eBay Fee Calculator is well-known for researching competitor pricing. The PayPal Fee Calculator is a useful instrument for anyone trying to easily calculate transaction fees related to PayPal. 4. Calculate: Click on the calculate paypal button to get the price particulars. Use PayPal’s Customer service Message to inform customers how they can get in contact with you. Accuracy: It ensures you get precise calculations for the charges.

Use a PayPal Commission Calculator to factor in these charges and alter your charge calculations. In fact, the best option to avoid paypal charges is simply to request your shoppers use other types of cost as a substitute. Payment processors handle refunds in case the fee was made accidentally, or the shopper needs to return the bought item. These fees can differ primarily based on several elements including the transaction amount, the nation of the sender and receiver, and the type of fee. There are numerous versions accessible on-line, together with the international PayPal fee calculator and the PayPal fee calculator 2024, to accommodate your particular needs. Understanding the charges involved can make it easier to manage your finances more effectively and ensure that you're not caught off guard by unexpected costs. A PayPal Fee Calculator is an important on-line instrument designed to help customers determine the fees associated with their PayPal transactions. This software is an indispensable asset for anyone looking to forecast the prices related to their PayPal transactions. Operating primarily based on key financial metrics, the calculator assists customers in evaluating the charges associated with sending or receiving cash through the PayPal platform. A PayPal fee calculator 2024 can show you how to plan your finances more effectively.

Use PayPal Balance: If in case you have a PayPal steadiness, you should use it to cover part of the transaction cost, which might help scale back the fee. The free charge calculatoris designed to help you retain track of prices in your subsequent transaction with PayPal. PayPal prices fees per transaction. 2. Select Currency: Choose the currency used in the transaction. Currency Conversion Fee: Around 3-4% of the exchange fee. You’ll pay this trade price any time you ship cash, withdraw funds, or accept and robotically convert money into one other currency. For example, the rate will change relying on whether or not you’re converting to USD, CAD, or overseas currencies. When you’re in instructor-pupil mode with somebody, and you’re guiding them, maybe hunched over the laptop, or no matter it's, they are likely to belief anything you tell them in trainer-scholar mode, because that is our default technique of interplay with teachers. Let’s say you’re a freelance writer who earned $1,000 by PayPal transactions and one other $1,000 via direct deposit from a single client. Combine Transactions: Group transactions to chop down on fees. Perhaps one of the best approach to offset paypal charges for receiving cash is by passing them on as a billable expense. Knowing the charges for PayPal transactions helps you manage your cash extra successfully.